The dichotomy of today’s healthcare environment can be both exciting and frustrating. Point-of-care innovations are at an all-time high, but the associated coverage is confusing and constantly changing. New technologies we would like to offer our patients may be out of reach due to blurred lines between medical coverage and refractive coverage, carrier coverage policy decisions and shifts in payer policy—all of which force the consumer to take on a larger share of the cost through higher deductibles and copays.

This conundrum is best exemplified with the billing and coding of medically necessary contact lenses.

|

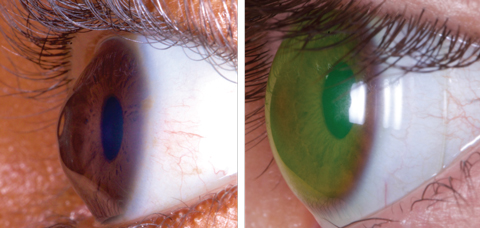

| Scleral lenses are often medically necessary for patients with irregular corneas, as seen here. |

No Consensus

The definition of medically necessary contact lenses should be clear by now, yet it continues to be parsed, segmented and redefined by third party carriers. Practitioners may have to bear part of the blame for this as well, as some fall short in establishing and documenting true medical necessity for a contact lens fit with respect to specific pathologies. From the payer perspective, some waste and abuse has occurred, resulting in greater scrutiny and tightening of payer policies. Because of this, medically necessary contact lenses have different definitions based upon the carrier providing the benefits. Here are a few examples:

EyeMed:1 “Contact lenses are defined as medically necessary if the individual is diagnosed with one of the following specific conditions:

Anisometropia of 3D in meridian powers.

High ametropia exceeding -10D or +10D in meridian powers.

Keratoconus when the member’s vision is not correctable to 20/25 in either or both eyes using standard spectacle lenses.

Vision improvement other than keratoconus for members whose vision can be corrected two lines of improvement on the visual acuity chart when compared to the best corrected standard spectacle lenses.

All requests for medically necessary contact lenses must be submitted by network provider for review and approval by our medical director before a claim will be processed for the service.”

VSP:2 “There are certain eye conditions that can only be corrected by contact lenses. Non-elective contact lenses, also called medically necessary contact lenses, are prescribed by your optometrist to correct these types of eye problems, whereas elective contacts are chosen by the patient to correct an eye issue that eyeglasses or sometimes laser surgery can also correct. Your eye doctor will let you know if you need non-elective contact lenses.”

Other carriers with well-defined definitions based on the specific clinical conditions observed in the patient include Aetna, HealthNet and Excellus BCBS Medicaid.3-5 These definitions have both commonalities and disparities, often making the correct use of medically necessary contact lenses quite carrier-specific.6

Providers must be familiar with the carrier-specific definitions and payer policies to properly prescribe and advocate for a non-elective contact lens prescription. Due diligence is critical in these cases to avoid any compliance issues.

Cracking the Code

According to the CPT section covering contact lens fits: “The fitting of contact lenses includes instruction and training of the wearer and

incidental revision of the lens during the training period.”7 The following codes describe the fit if performed by the physician according to the CPT:

92310: “Prescription of optical and physical characteristics of and fitting of contact lens, with medical supervision of adaptation; corneal lens, both eyes, except for aphakia.”

92311: “Prescription of optical and physical characteristics of and fitting of contact lens, with medical supervision of adaptation; corneal lens for aphakia, one eye.”

92312: “Prescription of optical and physical characteristics of and fitting of contact lens, with medical supervision of adaptation; corneal lens for aphakia, both eyes.”

92313: “Prescription of optical and physical characteristics of and fitting of contact lens, with medical supervision of adaptation; corneoscleral lens.”

Note: While the 92313 code description does not specify unilateral or bilateral, the Centers for Medicare and Medicaid Services (CMS) indicate that it should be considered a unilateral fit.

Other important codes include:

92071: Fitting of contact lens for treatment of ocular surface disease. (This is considered a unilateral code.)8

92072: Fitting of a contact lens for management of keratoconus, initial fitting.8 Because this is a bilateral code, make sure to report materials in addition to this code using either 99070 or the appropriate Healthcare Common Procedure Coding System (HCPCS) Level II material code. According to the CPT, “For subsequent fittings, report using evaluation and management service or general ophthalmological services.” For every follow-up visit, use a 9921X or 92012 code to follow the keratoconic cornea—remember, you are following the keratoconic cornea, and the contact lens is just the treatment paradigm.

Refine and Modify

In many situations, “incidental revision of the lens during the training period” and “with medical supervision of adaptation” are both accomplished during the first post-contact lens dispensing visit. Once the proper vision and comfort criteria are met and you have either ordered the final lenses or have provided the patient with their contact lens prescription, the patient can be considered fit for the contact lenses and the service period for that particular code is over. Should complications arise, the best way to bill for office visits is by using the established patient ophthalmologic (9201X) or evaluation and management (9921X) codes because you are following or managing an ocular condition, not performing a contact lens check.

Practitioners must remember to code properly for the materials. These HCPCS Level II codes specifically describe a scleral lens, followed by the 2018 CMS National Average reimbursement amount:

V2530: contact lens, scleral, gas impermeable, per lens ($211.81)

V2531: contact lens, scleral, gas permeable, per lens ($555.28)

Other material codes that may be applicable, depending on the technology, include:

V2599: contact lens, other type (N/A)

V2627: scleral cover shell ($1,501.39)

These are all based on a per-lens reimbursement amount, and the lens type and V codes used must match. Many carriers now request invoices as well.

Finally, make sure not to confuse coverage with reimbursement or fees. Your fees should be based on a consistent methodology across the patient spectrum without bias or discrimination. Remember the “golden rule”: one fee per CPT code, no matter who is paying. A patient’s benefits for materials as paid by a third party and your fees are two separate issues.

|

| These images show a keratoconus patient before, at left, and after being fit with a medically necessary scleral lens. Photos: Tom Arnold, OD |

The Notification System

The US healthcare system is designed to allow a physician to be paid 100% of the time for 100% of the services and materials they provide if the physician and their staff do their jobs correctly. While you may not get paid 100% of your customary fees, if you do what you are supposed to do, you should never be in a situation where you have to write off a service or material fee in its entirety.

To eliminate write-offs, start by exercising proper use of an Advanced Beneficiary Notice (ABN). While an ABN is specifically designed for Medicare Part B patients, it can be modified for commercial carriers. If you are providing care for a Medicare Part C (Medicare Advantage) patient, an ABN generally does not apply. Be sure to check each of your carrier’s website or provider manual and use the specific waiver of liability form they provide.

An ABN is a written notice a provider gives to a Medicare Part B beneficiary before providing items or services when the provider has reasonable knowledge that Medicare will not pay for some or all of the items or services. This is not a general or long-standing form, but rather a per-occurrence, per-procedure form and must be completed prior to providing the patient with services. The patient must sign the ABN form, and you must include it in your electronic health records and make it a permanent part of the patient’s medical record.

The ABN requires that you explain what services or materials you are proposing to provide, why they may be denied by the carrier and the costs of the specific service or materials. This allows the patient to make an informed decision about the services or materials and make sure they’re aware that they may have to bear financial responsibility. The ABN provides three options for patients:9

Option 1: I want the __________ listed above. You may ask to be paid now, but I also want Medicare billed for an official decision on payment, which is sent to me on a Medicare Summary Notice (MSN). I understand that if Medicare doesn’t pay, I am responsible for payment, but I can appeal to Medicare by following the directions on the MSN. If Medicare does pay, you will refund any payments I made to you, less co-pays or deductibles.

Option 2: I want the ______________ listed above, but do not bill Medicare. You may ask to be paid now as I am responsible for payment. I cannot appeal if Medicare is not billed.

Option 3: I don’t want the _________________ listed above. I understand with this choice I am not responsible for payment, and I cannot appeal to see if Medicare would pay.

If you are adapting an ABN for a commercial carrier, create a new form and substitute the word Medicare with your insurance carrier. In each option listed, you can get paid on the date of service rather than waiting for the carrier to make a coverage decision. It is always preferable to write a refund check to the patient than to manage the accounts receivable situation created by not collecting at time of service.

Because an ABN form or its derivative for commercial carriers is never submitted to the carrier, you must use modifiers to let them know you have properly completed the ABN form. Four common modifiers can be appended to the CPT codes for procedures that may be denied by the carrier. Depending on the service provided and the specific circumstances, the modifier can be either required by Medicare or voluntarily appended to the CPT code. Here are Medicare’s definitions for each modifier:

Modifier GA: Waiver of liability statement issued as required by payer policy, individual case. When this modifier is appended to a CPT code, it reports that you issued a required ABN for a service and is on file. CMS will assign financial liability to the beneficiary should the services be denied. The financial liability will be legally transferred to the patient, and you can bill the patient for this service.

Modifier GX: Notice of liability issued, voluntary under payer policy. When you append this modifier to a CPT code, it reports that you issued a voluntary ABN for a service that is statutorily excluded from Medicare reimbursement. Medicare will reject non-covered services appended with GX and assign liability to the beneficiary. Since this is a voluntary ABN, the patient always has financial responsibility for the service.

Modifier GZ: Item or service expected to be denied as not reasonable and necessary. When you use this modifier, it reports that you did not issue an ABN for a particular service. CMS will automatically deny the service and indicate the beneficiary is not responsible for payment. Because you did not obtain an ABN prior to performing the service, you are not allowed to bill the patient.

Modifier GY: Item or service statutorily excluded or does not meet the definition of any Medicare benefit. When this modifier is appended to a CPT code, it reports when a service is specifically excluded by Medicare, and you did not issue an ABN to the beneficiary. CMS will deny these claims and the beneficiary will be completely responsible for all financial liability.

Modifiers GA and GZ are often used if a procedure does not meet medical necessity as determined by a Medicare Local Coverage Determination or National Coverage Determination. Modifiers GX and GY, on the other hand, are used for items or services statutorily excluded from the Medicare program. Here, the use of an ABN is optional and informational only, but provides proof the beneficiary understands he will be liable for payment for these services. When using either modifier, the provider should bill the patient for the services provided.

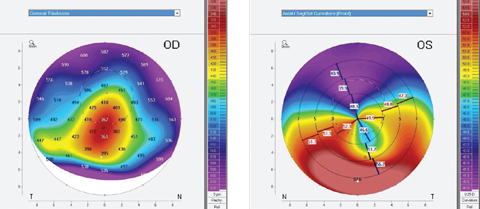

|

| Topography can be instrumental when fitting medically necessary contact lenses for patients with conditions such as pellucid marginal degeneration. Photos: Tom Arnold, OD |

Reimbursement

When you are a contracted provider with a specific carrier, you are generally bound by the provider agreement to accept the maximum allowable reimbursement for services or materials provided to the patient, as long as your customary fees are equal to or higher than the carrier-stated maximum.

Most carriers do not allow you to bundle or unbundle your services and materials for financial gain. Additionally, most carriers do not allow you to bill the patient the difference between the carrier’s stated maximum allowable and your customary fees. As a result, you must accept what the carrier allows for covered services and materials. Generally, the only way to avoid continued underpayment is to terminate your provider agreement with the carrier.

In some situations, the carrier may not be aware of a new lens technology, and the reimbursement may be lower than the cost of the material. Here, establishing a line of communication with the carrier’s provider relations department is often beneficial. If you can provide documentation such as invoices, product descriptions and statements of medical necessity explaining why you feel patient outcomes would be enhanced with the new technology, the carrier may adjust payment policy to accommodate the new lens option.

Today, many of these services and materials are excluded from patient coverage, making patients fully responsible for payment. If you are considering discounting your professional services or materials, please be aware of applicable rules and regulations surrounding your discounting policies. Generally, a discount should not exceed 10%, and the net discounted amount should never be less than what you are accepting from Medicare as payment in full. You would not want to jeopardize your established reimbursement pattern with carriers by violating a discount policy.

As new contact lens technologies come to market and provide patients with greater benefits with medically necessary contact lenses, it is essential we prepare our practices accordingly. Ensure profitability and peace of mind by establishing internal controls and policies to match your increased clinical offerings. When you achieve good compliance, you will be able to enjoy peace of mind despite a highly scrutinized coverage environment.

Dr. Rumpakis is president and CEO of Practice Resource Management, Inc., a firm that specializes in providing consulting, appraisal and management services for healthcare professionals and industry partners. He is also Review of Optometry’s clinical coding editor and authors the monthly Coding Connection column.

1. EyeMed. FAQ. http://portal.eyemedvisioncare.com/wps/portal/em/eyemed/members/faqglossary. Accessed December 13, 2017. |